Boost your Google Rankings with our FREE SEO Audit 🚀

Boost your Google Rankings with our FREE SEO Audit 🚀

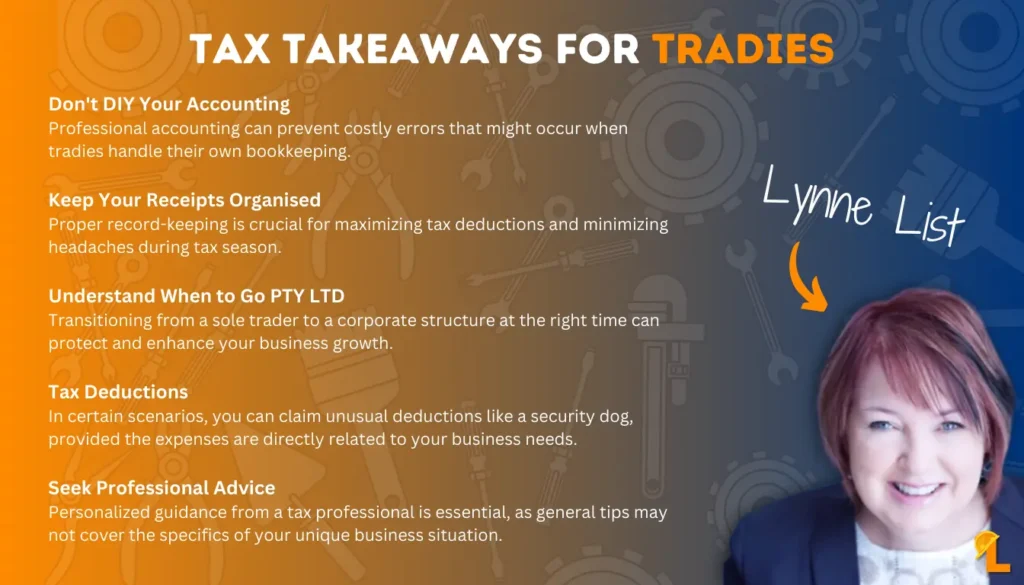

Real Tax Advice for Tradies with Lynne List

The Digital Tradie Podcast | Episode 4

G’day Legends,

In the first guest episode, I had the pleasure of speaking with Lynne List (my Mum) from Shine Accounting and Taxation, who shared her invaluable insights into managing the financials of a trade business.

Why Accounting Shouldn’t Be DIY

Lynne kicked off the chat with a crucial point: good accounting is non-negotiable. Emphasizing that many tradies might try to handle their books themselves to save money, but this can often lead to costly mistakes. It’s like trying to fix a leak with duct tape—temporary and probably going to need a professional fix eventually.

Top Tip for Tradies: Keep Those Receipts

If there’s one takeaway Lynne stressed for everyone, it’s the importance of keeping your receipts organised. Misplaced receipts are missed opportunities for deductions, and that’s like leaving money on the table—or worse, in the walls of a job site, never to be seen again.

The Cost of Cutting Corners

When it comes to taxes, cutting corners can end up being more expensive in the long run. Lynne highlighted that small errors in bookkeeping might not only cost you financially but could also attract the dreaded ATO. Ensuring you have professional help with your books is like having the right measurements before you cut—essential for getting it right the first time.

From Sole Trader to Incorporated: Timing Your Business Growth

Understanding when to shift from a sole trader to a corporate structure is another area where Lynne provided clarity. This decision is critical and can protect and grow your business effectively, much like upgrading your tools as your skills expand.

Debunking Tax Deduction Myths: Can You Claim Your Dog?

One of the more surprising moments of our chat was when Lynne addressed the possibility of claiming your dog as a tax deduction. Yes, you read that right! If your furry friend doubles as a security guard for your tools on the job site, their expenses could potentially be deductible. This includes costs like food and vet bills, provided the dog is primarily used for security. It’s an unconventional write-off, but it’s a testament to the intricacies of tax law!

Conclusion: Professional Advice Is Key

To wrap up, Lynne reminded us of the importance of personalised professional advice. Every trade business is unique, and while general tips are helpful, specific guidance from a tax professional is indispensable.

If you need Tax advice you can contact Lynne at https://www.shineaccounting.com.au/. Additionally, if you need any help with Digital Marketing check what LIST Media has to offer.

Share this post with your mates!

David List

Trade Magnet

The CRM that gives a S#!T about Tradies

Track all your leads, reviews and Facebook ads in one place. You can even build your own website!

Services

-

Facebook and Google Ads Managment for Tradies

$500 ex. GSTWe understand the importance of a transparent and fair pricing model. That’s why we’ve developed our unique 5-20-5 payment strategy,…